A new generation of Chinese entrepreneurs

TechCrunch, a technology publisher from Silicon Valley, has recently organized a conference in Shekou, not far from Hong Kong, where many of China’s most promising entrepreneurs gathered together to discuss business. The Chinese internet giants known as BAT (Baidu, Alibaba and Tencent), have been overshadowed by companies such as Didi Chuxing, a ride-sharing firm that pushed America’s Uber away from China, and Mobike, a bike-sharing startup that is going global.

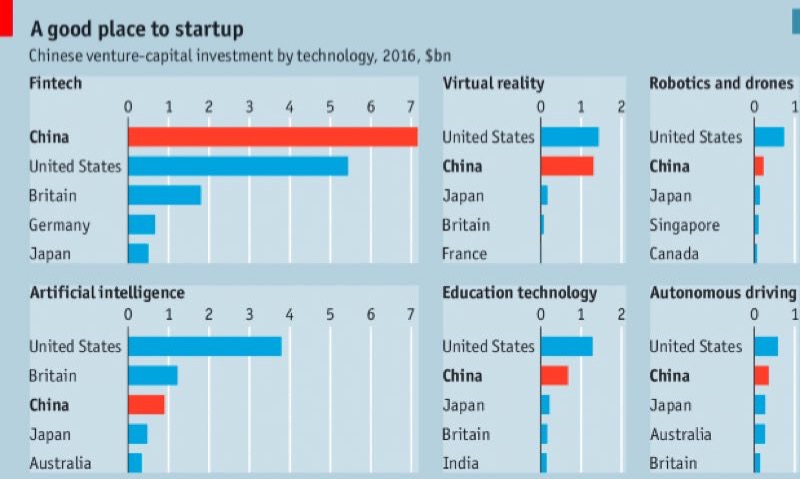

These startups are part of a new wave of young firms emerging from a past where innovation in China meant copycats and counterfeits. The driving force now is a bold, brilliant and globally minded generation of entrepreneurs. This new generation brought huge venture-capital (VC) investment into Chinese firms, from €10.2 billon in 2013 to €65.6 billion in 2016. Last year, China led the world in financial-technology investments, and Beijing is closing on America in other sectors – namely virtual reality, robotics and drones, artificial intelligence, education technology and autonomous driving.

China’s 89 unicorns (startups valued at €850 million or more) are worth over €300 billion, approaching the combined valuation of America’s. China’s innovators are using world-class technologies from supercomputing to gene editing. Having established themselves in the extremely competitive domestic market, now they are ready to ‘go out’ and invest abroad.

There are three main reasons behind the impressive growth of Chinese startups. First, being China the world’s second biggest economy, its domestic market is big enough for firms to obtain great profit just by succeeding at home. Second, Chinese consumers are wealthy and insatiable, an advantage to young entrepreneurs with excellent products but relatively new brands. Chinese shoppers are extremely open to new technologies, eager to experiment and, most important, ready to forgive if the product is not perfect. This helps small startups to reach a vast market cheaply. Third, state-dominated industries ranging from banking and telecommunications to health care are extremely inefficient and often hostile to consumers. In this sense, newcomers, with business models that put the costumer first and offer the last technology, have an unprecedented economic vantage.

The government’s inability to run industries well is counterbalanced by a willingness to support new ventures, especially in areas such as transport. The government has helped, for example, to create the market for electric-vehicles (EV) and, following a recent ban on petrol engines after 2030, China will have a long-term lead in the global EV market. Nio, a startup founded by Chinese entrepreneur William Li and specialized in making electric racing vehicles, is the symbol of this EV revolution in China (for those interested in getting more info on Nio, click here).

The iconic example of the extraordinary power of Chinese startup is represented by Didi Chuxing. Given the fact that car in China is not cherished cultural icon as it is in America, Chinese people are open to alternative forms of mobility such as ride-sharing. This has made Didi the world’s second most valuable startup after Uber. Didi’s story shows how local companies can cause global disruptions with sharing-economy services tested in China.

Chinese young startups mix their familiarity with home market and customers, together with foreign VC investments and CEOs with global experience. This has resulted in highly competitive companies with world-class people and technology at their disposal.

Chinese young enterprises are clearly going global, but there is plenty of scenarios in which they could stumble. In fact, the road ahead might be bumpier than expected. Sharp recession, banking crisis, and the volatility of foreign markets could lead to a reduced VC investments. Many new firms involved with sharing economy and online finance operate in grey areas, which are vulnerable to any arbitrary new internal regulation.