The role of the Public Sector in Financing Innovation and Entrepreneurship – Challenges and Opportunities in China

The industry of Private Equity (PE) and Venture Capital (VC) has become a global one, and China is playing a growing role in it. With an amount of $44 billion PE funds raised in 2014, China is now the biggest player in PE industry in the world. Research has proved that a country’s growth does not come from an increase in inputs, but from productivity or innovation, and Venture Capital has an important role in encouraging innovation. Being able to stimulate domestic innovation is therefore of key importance to every country’s government. Professor Dell’Anese offered an overview on the variety of good and bad policies already implemented by different governments in the effort of boosting innovation in their country. Future perspectives and lessons for China have been also analysed during this seminar.

To discuss the challenges and opportunities posed by the role of public sector in financing entrepreneurship and innovations, a presentation was made by Professor Luca Dell’Anese, Associate Dean of the School of Economics and Business Administration of Chongqing University. Galileo Galilei Italian Institute and DCafè were honoured to welcome at this event Mr Sergio Maffettone, Italian Consul General in Chongqing, Professor Meng Weidong, Vice-president of Chongqing University, and Mr Paolo Bazzoni, Director of the Italy-China Chamber of commerce in Chongqing. The event was chaired by Mr Francesco Silvestri, Acting Director of Galileo Galilei Italian Institute.

The new role of China in the PE/VC industry

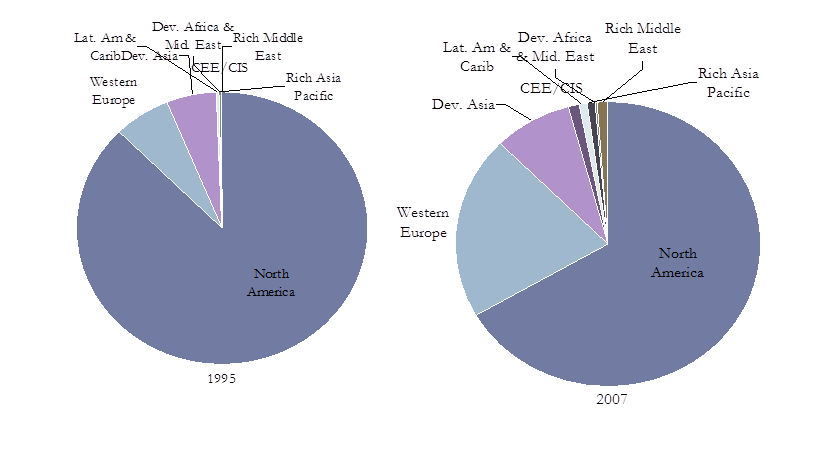

Professor Dell’Anese started guiding the audience through an overview about the variety of approaches to stimulate domestic innovation adopted by the public sector in different countries in the world. Starting with a chart that compares the PE/VC industry in 1995 and in 2007, the speaker noted that North America – meaning chiefly the US – was largely dominating the scene for the initial phase of the industry development, while, by 2007, the industry was already become a global one, with Asia playing a role in it.

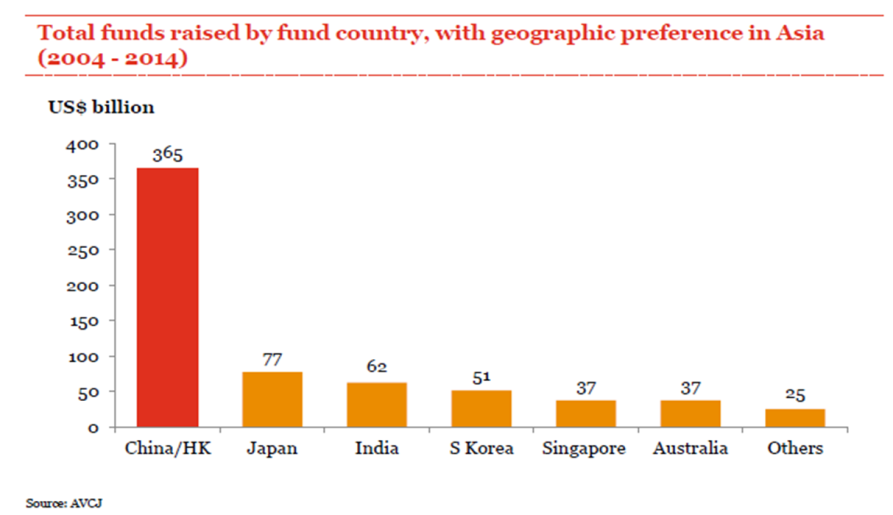

The presentation proceeded to underline the new role China is now playing in respect of the global industry. With an amount of $44 billion PE funds raised in 2014, China is becoming the biggest player in PE industry in the world, in terms of both funds raising, and amount of money invested in the Mainland. A comparison of the total funds raised over the period 2004-2014, shows that Mainland China and Hong Kong are way more attractive for investors than any other Asian country.Progressively, the funds raised in Mainland China are expanding in the market. Even if the last few years have recorded a decline of foreign funds invested in the Middle Kingdom, Renminbi funds are considered relevant in size since 2008. In general, a growing number of Chinese funds are playing a leading role in the sector.

The presentation proceeded to underline the new role China is now playing in respect of the global industry. With an amount of $44 billion PE funds raised in 2014, China is becoming the biggest player in PE industry in the world, in terms of both funds raising, and amount of money invested in the Mainland. A comparison of the total funds raised over the period 2004-2014, shows that Mainland China and Hong Kong are way more attractive for investors than any other Asian country.Progressively, the funds raised in Mainland China are expanding in the market. Even if the last few years have recorded a decline of foreign funds invested in the Middle Kingdom, Renminbi funds are considered relevant in size since 2008. In general, a growing number of Chinese funds are playing a leading role in the sector.

Why is Private Equity and Venture Capital important from a government perspective?

Professor Dell’Anese explained the main reasons why policy makers should care about their country’s PE/VC industry, and why it is worth developing policies to foster innovation:

1. Since 1950s, research studies have proved that the leading part of a growing country does not come from an increase in input, but from an increase in productivity; therefore innovation is key to growth. This must be taken into account especially in a country like China, where the business development model based on investments and growing inputs has reached its limit, and the government is now trying to change its structure.

2. Results of economic research of the last decades pointed out that new firms tend to be particularly innovative and generally better suited to develop innovation. Moreover, recent research also proved that new firms that enter innovative sectors (such as internet and biotechnology) have an equal or higher probability to innovate if compared to already established firms. No correlation exists between the size of a firm and its potential for innovation.

3. Venture Capital and Private Equity can play an important role in encouraging innovation, a strong correlation is identified between the amount of investments in VC and the presence of innovative firms in the market.

What should the government do to encourage PE/VC industry?

The government always plays a key role in developing the PE industry and VC market in a country. When good policies are put in place, they can create virtuous cycle that generates opportunities to develop an ecosystem for VC and PE.

A positive element to promote such ecosystems is the presence of a stamp of approval provided by the government. Since private investors cannot predict if the technology they invest in will be lucrative or not, the government’s approval can influence the investors’ behavior.

Finally, if the government is able to enhance knowledge flow, this could create an environment where groups of firms attract new talents; being the latter willing to start their own firms, spin-offs will be generated in a self-reinforcing cycle that will finally turn into an PE/VC ecosystem.

What can go wrong?

Is it easy to develop an ecosystem? Many countries tried, but failed. There is a variety of different factors that may determine a failure:

1. The government’s incompetence. An example of such a situation is the case of French government, which in the 1980s tried to create an industry champion to compete with the big players on the scene. Different companies were forced to merge, but as a result the smaller companies were crushed and the bigger ones were still not able to compete in the market.

2. Regulatory capture: the government provides the resources, which are captured by entities with direct relations with it, but turn out not to possess a real potential for innovation.

Enhancing the entrepreneurial climate

There is not a rich literature about what governments can do to enhance the entrepreneurial climate; however, certain policies have been identified as creating a more favorable environment for the development of an ecosystem for Venture Capital:

1. Get the legal framework right, thus implying transparent partnerships, preferred shares and not common shares. China is pretty weak in this area, and, even if the attractiveness of its market currently nullifies the negative effects, China should consider to improve its legal framework.

3. Ensure access to cutting-edge technology. For example, creating a link between academic institutions or research university and the industry.

4. Introduce tax incentives: lower capital gain taxes have the effect of boosting Venture Capital fundraising.

5. Introduce specific trainings for entrepreneurs

To increase the PE/VC market’s attractiveness, an important component is the chance to access human capital abroad, which is fundamental and often even overlooked: have access to top talents is key in an industry you cannot afford not to be the leader of the sector.

Both timing and size are important in designing a successful VC program. VC development and the creation of an ecosystem are extremely time-consuming, and need to be considered as strategic priorities with continuity. In term of size, the program should not be too small, because it would turn ineffective, nor too large, which could crowd out private funding.

Lessons for China

The speaker concluded with some consideration on the specific case of China’s PE/VC industry. China has done well in terms of fund raising investing, but – he highlighted – China’s vast territory does not assure that ecosystems will develop somewhere around, as is commonly assumed. This supposition proved wrong for the US; moreover, presuming the existence of different ecosystems on the Chinese territory seems unrealistic, because it would imply that some of them would be sub-standards and some others will be absorbed.

Professor Dell’Anese suggested that, to finance innovation and entrepreneurship, the Chinese government should conform to global standards, especially with regard to its legal framework. Secondly, China should leverage the academic and scientific research base: identify which institutions could provide effective support, and build a network between these institutions and business. Thirdly, develop global connection and avoid a full control of the government, in favor of the market autonomously providing direction. Finally, a strict program evaluation is recommended.

China has so far succeeded in attracting a great number of funds in PE/VC industry, as well as in developing well-functioning areas, including Beijing and Shanghai, which can already be considered ecosystems. China’s next steps should entail the achievement of innovation and leadership in technology, attempt that many countries tried, but very few succeeded.